Monday, May 3 marked the start of the Epic Games v. Apple trial in Oakland, California, with the two companies facing off over the iOS developer’s August removal of Fortnite from the App Store and the policies that led up to that point.

So far, the trial has featured a two-day testimony from Epic Games CEO Tim Sweeney, an outspoken critic of Apple and the man responsible for suing the phone maker. Lawyers from Epic and Apple both cross-examined Sweeney throughout May 3 and 4, with questions ranging from basic video game topics to complex ones around Fortnite cross-wallet transactions and cross-platform play between devices, as well as Epic’s desire to break open the App Store policies through a legal, marketing, and public relations campaign.

The two-and-a-half-week trial has featured representatives from other app developers and companies who are frustrated with Apple’s commission structure—from yoga app Down Dog CEO Benjamin Simon to Nvidia GeForce Now director Aasish Patel and Xbox executive Lori Wright. A number of academics familiar with antitrust and software have also testified. Apple has gotten time to defend itself too, with Apple Fellow Phil Schiller—who’s run the App Store since its inception—and software lead Craig Federighi taking the stand.

Apple CEO Tim Cook will testify but hasn’t yet as of May 20. May 21 is expected to be the final day of testimony before a court-agreed summary from each side’s counsel and the set of closing arguments on May 24. Judge Yvonne Gonzalez Rogers will then make her crucial judgment next week.

Along the way, new facts about the gaming industry, its publishing deals, and Apple’s internal processes have been revealed.

Here’s what we’ve learned so far:

Wednesday, May 19

Table of Contents:

Macs have a not “acceptable” amount of malware, per Apple software executive

Apple’s Federighi testified in Oakland on May 19. During that testimony, Federighi compared and contrasted the iOS and Mac ecosystems, saying that iOS has a “dramatically higher bar” for consumer protection. But the most stunning quote came around security on the Mac.

“Today, we have a level of malware on the Mac that we don’t find acceptable and that is much worse than iOS,” Federighi said.

He went on to explain that this is a result of Mac users ability to install software from anywhere—unlike iOS users, who without warranty-voiding jailbreaking are limited to just the App Store, where every app is vetted by Apple before publishing.

The statement that Macs have significant malware issues is a new revelation from the California-based computer manufacturer. Apple’s often prided itself on its security around Mac OS and iOS. From 2006 to 2009, Apple ran an ad campaign called “Get a Mac,” which featured two actors, one as a PC and the other as a Mac. Among these series of ads were ones that comically called out Windows for its problems with viruses—and said that Macs couldn’t get them.

Tuesday, May 18

Table of Contents:

- Apple SVP Phil Schiller warned of issues around 30 percent revenue cut in email to Jobs, Cue in 2011

Apple executive Phil Schiller foresaw issue with 30 percent revenue cut in 2011

In an email to Apple co-founder Steve Jobs and fellow senior vice president Eddy Cue in 2011, then Apple SVP Phil Schiller outlined his concern for the longevity of the company’s 70-30 split on app purchases. Schiller said that, while he’s personally in favor of the 30 percent cut that Apple takes from developers, he believed a competitor would soon undercut them and take away market share from iOS among smartphones.

“Do we think our 70/30 split will last forever?” Schiller wrote. “If someday down the road we will be changing 70/30, then I think the question moves from ‘if’ to ‘when’ and ‘how’. I’m not suggesting we do anything differently today, only that whenever we make a change we do it from a position of strength rather than weakness.

“Just as one thought, once we are making over $1B a year in profit from the App Store, is that enough to then think about a model where we ratchet down from 70/30 to 75/25 or even 80/20 if we can maintain a $1B a year run rate?”

Apple grossed $64 billion in App Store revenue in 2020, according to CNBC. If it took a 30 percent cut of that revenue, it made $19.2 billion on the App Store before operating expenses. Much of the Epic v. Apple case centers around the fairness of the 70-30 split—a standard across many platforms, including iOS, Xbox, PlayStation Store, Nintendo eShop, and Steam, but one that’s drawn fire from developers across the world.

Monday, May 17

Table of Contents:

Apple is OK with games within a game, but only if independently created

After a straight week of primarily academic testimony, Schiller testified on May 17. Schiller’s first day of examination brought a few topics into question: Who does the long-tenured former Apple senior vice president of marketing view as the company’s competitors? How has the App Store evolved since it launched on the iPhone more than a decade ago? But also, a contested question throughout the entire trial: How is Apple handling other games and apps within another app?

Schiller’s answer to that last question left more questions than answers. Apple is OK with games within another app, but only if it’s created by independent “creators,” not other developers, according to Schiller. That answer surrounded a line of questioning about Roblox, the popular game that allows for independent creators to create unique experiences using a set of toolkits and is available on iOS.

Throughout the past two weeks, Apple’s grip on its closed-off market has been strongly criticized by some academics, Microsoft’s Lori Wright, Nvidia’s Aasish Patel, and of course, Epic’s counsel. Apple has placed significant scrutiny on the app approval process around xCloud and Nvidia GeForce NOW, Microsoft and Nvidia’s cloud gaming services, despite it having its own game streaming service, Apple Arcade.

Monday, May 10

Table of Contents:

- Steve Jobs didn’t expect App Store to be profitable

- Coalition for App Fairness would not exist if Apple complied with Epic’s requests, Apple lawyers allege

Steve Jobs didn’t expect App Store to make Apple money

Chairman of Global Economics Group Dr. David Evans, an academic and college professor who’s dedicated his life’s work to the analysis of competition policy, took the stand on Monday, May 10. Evans was among those previously deposed by Epic and Apple’s counsels and then called again to testify under oath in court.

During his examination, Evans referenced a 2008 interview with late Apple co-founder Steve Jobs, who during his second tenure running Apple pioneered the Mac, iPod, and iPhone. There, when questioned about potential monopoly power around the App Store, Jobs said he did not anticipate the marketplace to make a significant profit for the company as it does now.

“Just to make it a little clearer, we don’t intend to make money off the App Store,” Jobs said in 2008. “I mean, we don’t make a lot of money off iTunes and the split with the music companies is about the same, so in the case of the iTunes Music Store, we give all the money to the content owners, and we are basically giving all the money to the developers here and if that 30% of it pays for running the story, well that will be great, but we just want to creative a very efficient channel for these developers to reach every single iPhone user.”

Coalition for App Fairness wouldn’t exist if Apple complied with Epic’s requests, Apple lawyers allege

About a month after its lawsuit against Apple, Epic announced the Coalition for App Fairness, a collective group comprised of the Fortnite developer and others, like Spotify and Tinder and OkCupid parent Match Group, who took issue with Apple and Google’s 30 percent commission on app sales.

But using a new document submitted to the court, Apple’s lawyers allege that if Apple complied with Epic’s requests for a special deal, then the game publisher would’ve never launched the coalition at all. That revelation came out during the examination of Epic Games vice president of marketing Matthew Weissinger, who testified on May 7 and 10 in court. Weissinger refuted Apple’s attorneys’ claim and said the coalition’s issues with Google are still valid regardless of Epic’s relationships with Apple.

Thursday, May 6

Table of Contents:

- Epic didn’t pay for Apple marketing support for Fortnite iOS launch, other events

- Epic took issue with App Store paid search ads

Epic didn’t pay for Apple marketing support for Fortnite

Apple App Store vice president Matt Fischer took the stand in Oakland on May 6. As Apple’s attorneys cross-examined him, Fischer spoke about the relationship between Epic and Apple and his personal relationship with Epic co-founder Mark Rein prior to the App Store dispute last August.

Fischer discussed the no-charge ways that Apple supports its developers, from its editorial portion of the App Store to special events around certain days like Christmas or May 4, which is celebrated by Star Wars fans (“May the 4th Be With You”). Fischer said Epic didn’t pay for Apple’s marketing support for the Fortnite launch on iOS in March and April 2018, nor any other campaigns Apple ran around special Fortnite events surrounding concerts featuring Marshmello and Travis Scott.

Fischer also broke down his relationship with other developers on the App Store and examined several surveys that Apple had conducted of iOS publishers. Fischer said feedback ranged from positive to negative and that Apple doesn’t offer preferential treatment to any developers.

Epic took issue with Apple’s paid search placement

During his testimony, Fischer discussed the App Store’s policies and how the company operates the marketplace. In documents submitted to the court as a basis for Fischer’s examination, new insight into how Apple charges for paid search advertisement placement arose—as well as emails from 2018 that showed Sweeney complaining to the company about it.

“As an iOS user, I just set up a new iPhone and installed the 12 apps I commonly use,” Sweeney wrote to a redacted Apple recipient. “None were the first search result when searching the App Store for the app’s exact name.”

Sweeney explained that when he searched for Dropbox, he received a paid placement ad for a Google app—presumably Google Drive, the company’s Dropbox competitor—followed by Files, Apple’s own file storage software. Dropbox, Sweeney said, wasn’t even available on the first page.

As for Fortnite, Sweeney said the App Store didn’t display his publisher’s game as the first result. Instead, paid results from Microsoft or a Fortnite competitor, such as PlayerUnknown’s Battlegrounds, would populate the search.

When Fischer forwarded the email to his Apple colleagues, they said that the Files placement was a manual placement, instituted around Apple’s WWDC 2015 that was never removed.

Apple is under fire from the U.S. government for anti-competitive behavior that lawmakers allege includes prioritizing its first-party apps in the App Store over its sometimes more popular competitors.

Wednesday, May 5

Table of Contents:

- Microsoft got Shadow accidentally removed from App Store

- Microsoft does not make money on Xbox console sales

Microsoft’s attempt to get xCloud on App Store got competitor Shadow booted off the marketplace

While making the case for Apple to approve xCloud, Microsoft’s cloud gaming service, for distribution on the cloud gaming service, it inadvertently got another cloud gaming service, Shadow, temporarily kicked off the App Store in February 2020.

Back-and-forth emails between Xbox executives and Apple App Store administrators, including Wright, revealed a dispute between Microsoft and Apple from last year.

Apple didn’t want to approve xCloud for the App Store last year, likely due to its policy around sideloading and access to third-party apps without going through the iOS app compliance process. In those emails, Wright and Xbox cited apps with interactive experiences, like Netflix and Shadow, whose apps were freely available on the App Store. Shadow was removed shortly after the exchange.

“We were showing two examples where a game or an application was able to exist, and we didn’t understand why we couldn’t,” Wright said. “I believe [Apple] ended up pulling Shadow out of the App Store based off this email we sent until they submitted changes. That was not our intention of course, it was a byproduct.”

Apple removed Shadow—which allows users to stream PC games to a mobile device—from the App Store twice in February 2020, but it has since been restored. It’s remained on the App Store since the second reinstatement that month.

Microsoft hasn’t launched xCloud natively on iOS (its beta is available via Safari web browser, like GeForce Now), but a tweet from Xbox executive Phil Spencer from April 2 confirmed that an iOS app is coming.

Microsoft doesn’t make money on Xbox console sales and wouldn’t turn a profit without 30 percent commission on digital game revenue

After a short back-and-forth between the judge and attorneys and the conclusion of testimony from Nvidia GeForce Now director Aasish Patel, Wright took the stand.

Wright outlined early why she didn’t view the iPhone as a competitor to Xbox—an important distinction that counters Apple’s argument that its 30 percent app sale commission is in line with its competitors, including Xbox. During her time on the stand, Wright also said Xbox doesn’t make money on the sale of Xbox consoles and that those sales are a net loss for Microsoft. Without the 30 percent commission on digital sales for Xbox games, Wright said, Microsoft wouldn’t make money on any portion of the Xbox.

Microsoft announced on April 29 that for PC games sold on the Microsoft Store, it’d only take a 12 percent commission from the developer, down from 30 percent, beginning in August. It continues to draw a 30 percent commission on digital games and in-app purchases on Xbox systems.

Tuesday, May 4

Table of Contents:

- Sweeney suggested to Cook in 2015 that iOS be open platform

- Epic pushed Xbox to make Fortnite multiplayer free-to-play

- Walmart was developing cloud gaming service for 2019 launch

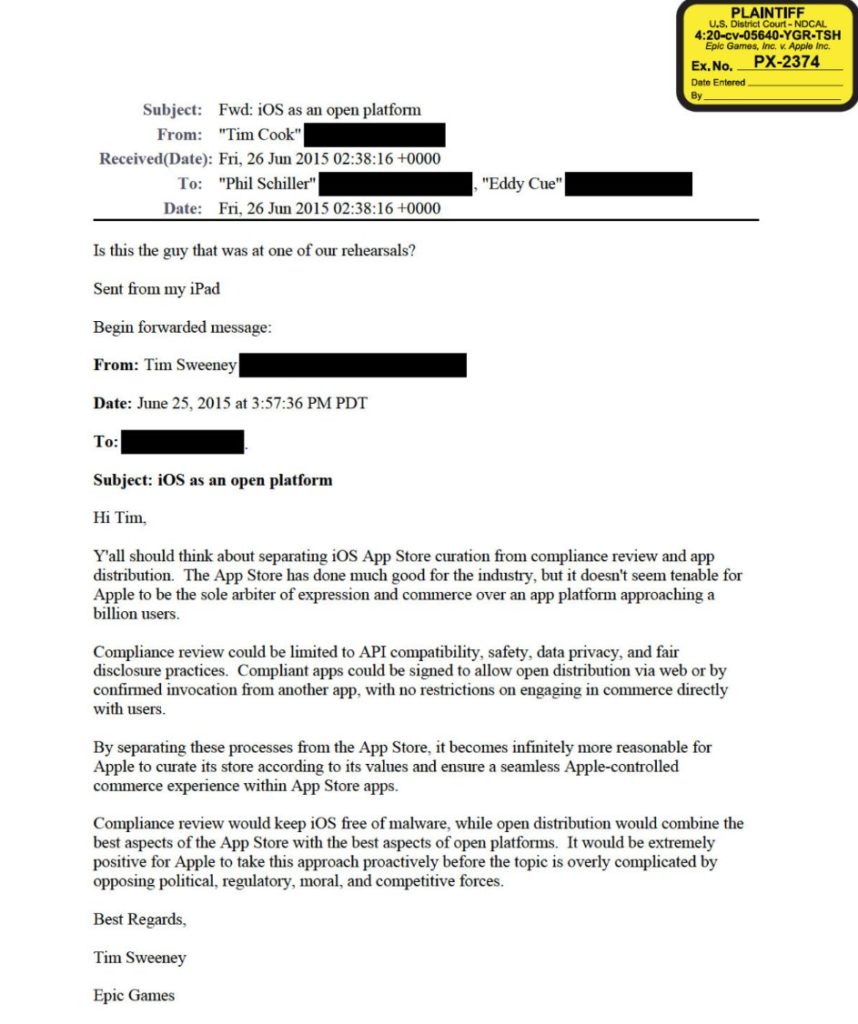

Sweeney emailed Apple CEO Tim Cook in 2015 suggesting iOS be open

Apple and Epic’s contentious 2020 summer negotiations weren’t the first time Epic campaigned for an open iOS.

In a new document submitted to the court, Sweeney emailed Apple CEO Tim Cook in June 2015 suggesting that Apple separate its compliance review for iOS apps from the App Store. Cook, confused who Sweeney was, forwarded the email to two of his executives, Phil Schiller and Eddy Cue, asking if Sweeney was “the guy that was at one of our rehearsals?”—referring to Apple’s WWDC 2015 conference. That year, Epic presented the Unreal Editor and a very early version of Fortnite on Mac to attendees of the conference.

In the email, Sweeney argued the separation of iOS app compliance checks and the App Store submission process would allow iOS to remain secure while allowing for a free market via sideloading. Sweeney said it’d be a positive look for Apple and predicted that Apple would face “political, regulatory, moral, and competitive forces” in the future. Apple is now under fire not just from Epic for its App Store policies, but also from antitrust regulators in the U.S. and European Union.

Epic pushed Xbox to make multiplayer free before Apple dispute

Coming into the trial, one email unearthed in discovery served as a punchline: “you’ll enjoy the upcoming fireworks show.”

Sweeney sent that email in early August 2020, about a week before it provoked Apple to kick Fortnite off the App Store, to Xbox executive Phil Spencer.

But more emails surfaced in trial on May 4, showing a back-and-forth discussion between the two game executives centering around Xbox’s requirement for users to subscribe to Xbox Live Gold to play online games. Sweeney was effusive in his support for Spencer and Microsoft in those emails, saying “while I can’t share details with any third party at this point, I give you Epic’s assurance that our efforts will be positive and supportive of Microsoft, Xbox and Windows.” Spencer agreed they’d work together to figure out a solution for the removal of the Gold requirement.

Microsoft ultimately did open the floodgates, removing the Gold requirement from multiplayer free-to-play games like Fortnite and Call of Duty: Warzone in April. It also made the Microsoft Store announcement in late April, just days before the Epic v. Apple trial began, in what seemed to be an apparent vow of support to Epic.

Walmart planned to launch cloud gaming service in 2019

Retail chain Walmart was developing a cloud gaming service with a targeted beta launch in July 2019, according to confidential documents revealed during the trial.

In an internal email released into evidence, Epic co-founder Rein said he tested the service in April 2019 and spoke to Walmart about its plans to launch a clip for “something like $2” that’d let users attach a controller to their phone. Rein said he played Fortnite on Walmart’s internal demo and that “the experience felt like playing on PS4 and superior to playing on Android or iOS.”

The service, Walmart pitched, would include functionality to play games featured on Steam, Origin, Uplay, Epic Games Store, Battle.net, and the Bethesda Launcher. Its technology originated from LiquidSky, a cloud gaming company that Walmart acquired in 2018.

USGamer first reported on the development of the Walmart platform in March 2019, with The Verge reporting that several developers, including Epic, signed on to produce and host games on the service. The project was halted at the beginning of the coronavirus pandemic in 2020, according to The Verge. Fortnite later launched on Nvidia GeForce Now, its cloud gaming service, in November 2020.

Monday, May 3

Table of Contents:

- Sony and Epic butted heads over Fortnite cross-platform play

- Epic Games Store is not profitable

- “Next-gen” Rocket League update coming in 2021

- Epic “overestimated” it could make $154 million off esports in 2019

- PlayStation 4 users purchased more V-Bucks than any other platform

- Epic made $15 billion from 2018 to 2020, mostly off Fortnite

- Epic considers Fortnite a “universe”

Sony and Epic were at odds around Fortnite cross-platform play

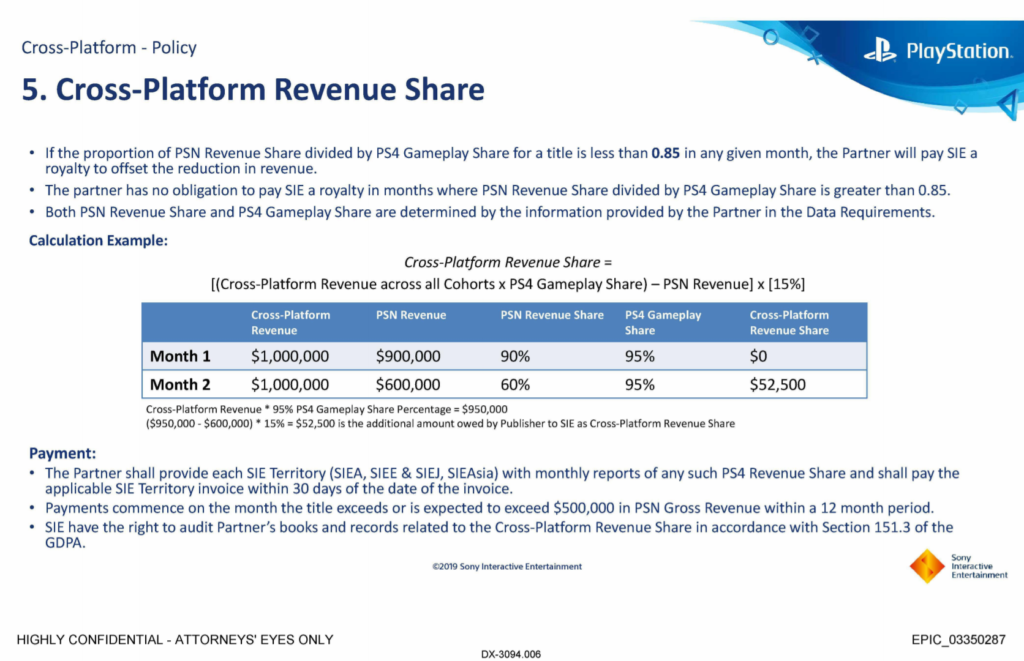

The end of Monday’s hearing moved into a 30-minute sealed portion of the proceedings. But that didn’t stop documents that were meant to remain confidential from accidentally leaking to members of the press. Among those files were contentious emails between Epic and Sony top brass around the launch of Fortnite cross-platform play on PlayStation 4 in 2018.

Because Fortnite was the most-played game on PlayStation 4 at that time, Epic felt it had significant leverage to push Sony to open up cross-platform play, new emails revealed. But Sony thought otherwise, with senior director of developer relations Gio Corsi saying, “many companies are exploring this idea and not a single one can explain how cross-console play improves the PlayStation business.”

Ultimately, Sony opened up Fortnite and other titles on PlayStation to allow crossplay, but curiously, with some financial kickbacks. A new document from August 2019 outlines a royalty structure for PlayStation if a certain number of a game’s users come from the platform.

Sweeney confirmed during his testimony that Epic agreed and then later paid additional fees to Sony to keep Fortnite cross-platform play compatible. He also said Sony is the only company, of the ones Fortnite is distributed on, to require such a royalty compensation. “In certain circumstances Epic will have to pay additional revenue to Sony,” Sweeney said.

Epic Games Store is not profitable

Epic’s own marketplace, the Epic Games Store, is not a profitable venture for the company, Sweeney said during his testimony on May 3.

In fact, Sweeney said the store loses the company hundreds of millions of dollars each year, with costs ranging from server hosting for download bandwidth, developer agreements to allow for free games each month, and others. The Epic Games Store cost the company $359 million in investment in 2018 to 2019. Sweeney said he anticipates the store will be profitable “within three or four years.”

Epic launched its marketplace platform in December 2018, about 18 months after Fortnite released. The Epic Games Store offered innovative revenue split models to developers, focusing on a 88-12 model, with Epic only taking 12 percent commission on sales. Epic also offers to cover its Unreal Engine royalty fees for any games published on the Epic Games Store—both policies a big boon for indie game developers.

New “next-gen” relaunch of Rocket League, including mobile apps, coming in 2021

In a slideshow dated June 2020 and presented as evidence for the court, Epic outlined some of its plans for Rocket League, which it acquired as a part of Psyonix in May 2019. The slides—while labeled “old slides” in the document—feature already executed plans for the vehicular soccer game, such as a 2D version that became Rocket League Sideswipe.

But curiously, one slide outlines Rocket League “Next,” a new client refresh for all platforms, including mobile, and cross-platform play and game progress between PC, console, and mobile. In the slide, Epic says it estimates a release for mobile in Q2 of 2021 before the refresh launches on other platforms. Epic has not confirmed if those timelines from the slideshow are correct since the document was submitted into court on May 3.

Epic “overestimated” revenues it could generate from esports by $154 million in 2019

One document cited an underperformance in expected revenues in 2019 for Epic, with a key point being that it overestimated that it’d make $154 million more than it did from esports.

Fortnite esports had a big year in 2019, culminating in the Fortnite World Cup, a four-stage stadium event that occurred over three days at Arthur Ashe Stadium in New York. The event featured a solo, duo, and Creative competition, as well as a Pro-Am featuring high-profile celebrities, such as pro athletes, actors, and musicians paired with famous Fortnite influencers.

The World Cup garnered a ton of attention for its $30 million prize pool, with the solo winner, 16-year-old Kyle “Bugha” Giersdorf, winning $3 million for his first-place prize. Bugha later appeared on late-night network TV shows and in a 2020 Super Bowl commercial, and even landed his own endorsement deals with retailers like Five Below. Epic, however, did not brand the World Cup with any sponsors or commercialize any other part of the process.

PlayStation 4 users purchased more V-Bucks than on any other platform

Epic presented the court a document outlining the commissions each platform has taken from the sale of Fortnite goods since its release in the summer of 2017. The document compared fees charged by Sony for PlayStation, Microsoft for Xbox, Nintendo for Switch, Apple for the App Store, Google for the Play Store, and Samsung for the Galaxy Store. All of those platforms charge 30 percent commissions on the sale of goods, except Samsung, which charges 12 percent, the same as Epic does to others on its own store.

In total, Epic’s paid billions of dollars in commissions for Fortnite sales. The highest earner, per that document, was PlayStation, who’s led the charge for sales of V-Bucks in Fortnite since September 2017. Behind Sony was Xbox, which has consistently been a high driver of revenues for Fortnite. Apple and iOS held the third position consistently until February 2019, when Fortnite purchases on the Nintendo Switch took over as the third-highest revenue driver for the game.

Epic made $15 billion in three years, the majority from Fortnite

Between 2018 to 2020, Epic generated $15 billion in revenue, with most of those revenues coming from Fortnite in 2018 and 2019, according to a new financial document entered into evidence during the trial.

That document showed that the developer made 97 percent of its 2018 revenues from Fortnite. That year saw the game burst into mainstream culture, from Ninja’s March stream with rappers Travis Scott and Drake and NFL wide receiver JuJu Smith-Schuster to the star-laden Pro-Am at the Banc of California Stadium in Los Angeles at E3 2018. Fortnite quickly became a staple of mainstream media coverage around gaming, from morning TV shows to many stories around the influencers, like Ninja, who made their name and wealth off creating content around the game. In total, Epic made $5.7 billion in 2018.

In 2019, 88 percent of Epic’s revenues came from Fortnite. Its total revenue that year amounted $4.2 billion for 2019, about $390 million less than it predicted in beginning-of-the-year estimates. The documents cited the esports overestimation as part of the reason it did not achieve its $4.59 billion estimate for 2019.

Epic considers Fortnite not a game, but a universe

Throughout Epic’s opening arguments and Sweeney’s testimony on May 3, the game developer attempted to show the court that it considers Fortnite less a game and more of a platform. It pointed to its wide reach and the Party Royale mode in Fortnite, which focuses more on social gatherings and less on the traditional battle royale play that first made the game famous.

In a series of documents, Epic highlighted its collaborations with celebrities—including Scott, who hosted a concert inside of Fortnite last year, and soccer star Neymar—and partnerships with companies like Marvel and DC Comics to include some of their characters in the game. It also revealed a number of never-before-seen planned releases, including a collaboration with NBA stars LeBron James and Zion Williamson, actor Dwayne “The Rock” Johnson, and fictional characters Master Chief from Halo, Kratos from God of War, and Samus Aran from Metroid.

Epic also pointed to non-gaming apps available for download on its Epic Games Store, such as Spotify and others, to prove that this is not a game-specific issue, as Apple’s attorneys seek to frame it. Epic hopes to make this case about all developers who incur Apple’s 30 percent commission on their app sales and have called on witnesses from other app developers, such as popular yoga app Down Dog, who will testify throughout the trial.

Make sure to follow us on YouTube for more esports news and analysis.

Published: May 20, 2021 12:30 pm